More Trading Will Be ‘Taken Over by Machines,’

Scott Kerson, Quant guru

Scott Kerson, Quant guru

Scorelab is a quantitative consultancy firm providing innovative technology solutions to the financial sector. We are a team of PhDs, quantitative analysts, data scientists and software engineer that run advanced trading strategies and research for our clients.

We specialize in machine learning application to systematic trading. Our extensive knowledge in machine learning differentiate us from our competitors. Consistent technological watch and research in AI allows us to stay ahead of the field.

Scorelab believes there is nothing more important than partnership with our clients. We constantly innovate and build solutions to meet their needs in this ever changing market environment.

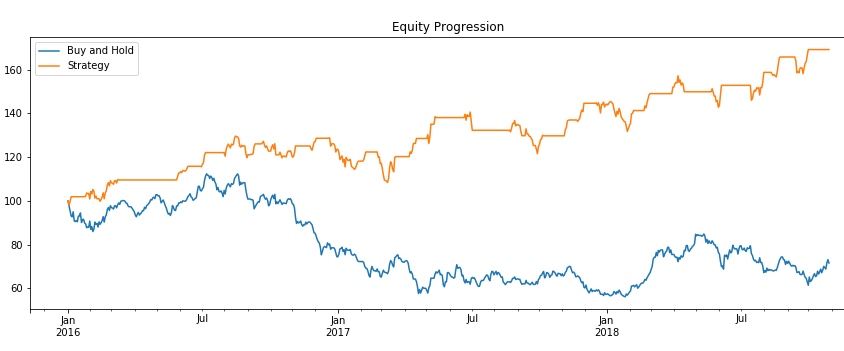

Our client wanted us to calculate long/short position signals, based on technical analysis methods in European and American markets.

As a result of our research and statistical analysis we have developed two powerful and original models. One of the models developed is based on the physical modeling of market noise and the other optimizes quantitative analysis signals through machine learning algorithms. These models are currently in production.

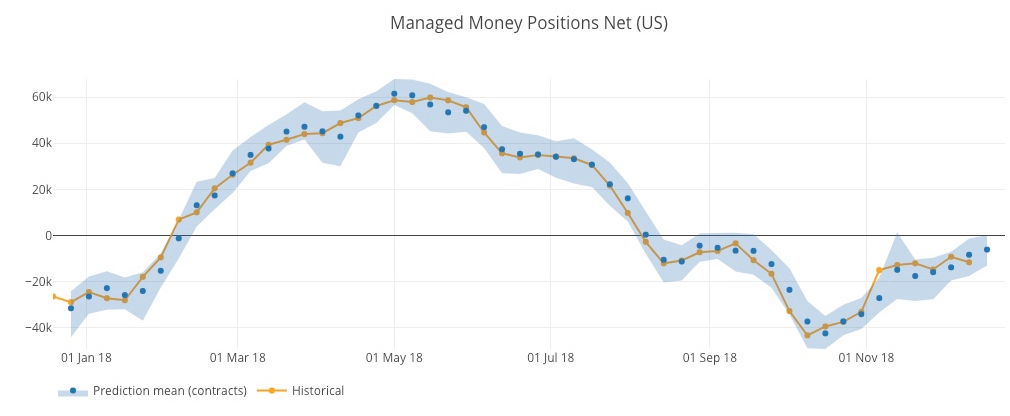

The customer wanted to predict with 3 days in advance the net position of “non-commercials“ (hedge funds) published in the weekly TOC report.

Our research and our machine learning methods allowed us to succeed to a prediction of the trend with a precision close to 90 %. This model, applied to other raw materials gives us similar results.

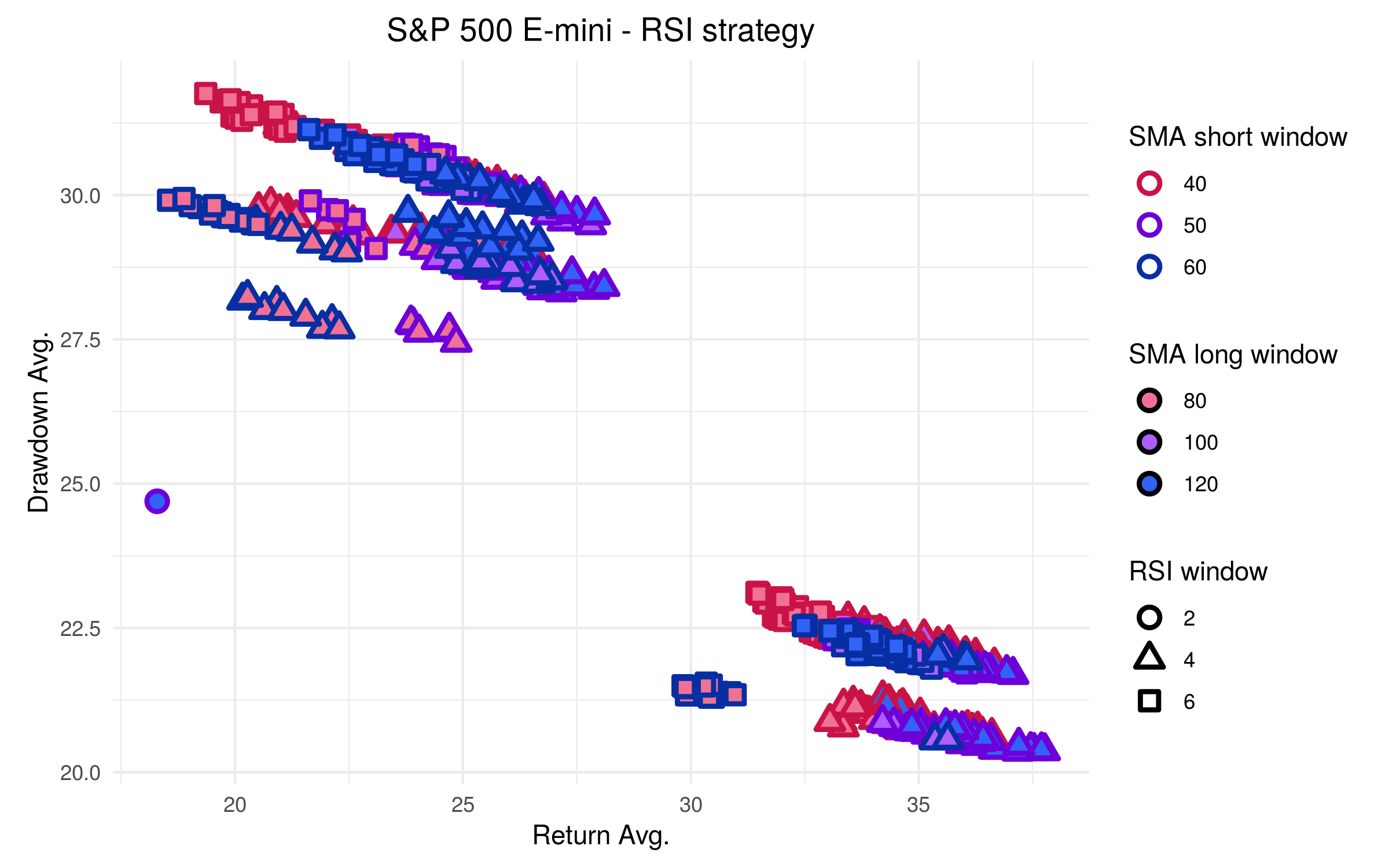

Even simple trading strategies can have lots of parameters, e.g. window lengths, thresholds for entry/exit...

We use highly parallel computers in the cloud in order to run thousands of backtest experiments and explore the high dimensional space of parameters.

There is no single criterion to optimize, e.g. return, drawdown, all sorts of ratios... We therefore developped interactive visualization tools in order to select optimal and robust parameter values.

Beside, some results obtained on the S&P 500 E-mini.

Your needs

Are you stuck with your current trading models and searching for alternative approach? Maybe you are looking for externalizing your quant research process? Or are you just interested in knowing how machine learning can help optimise your trading indicators and entire portfolio? Talk to us.

© Scorelab, 2019